Sustainability Reporting Frameworks Headed Towards One?

What is Happening & Why?

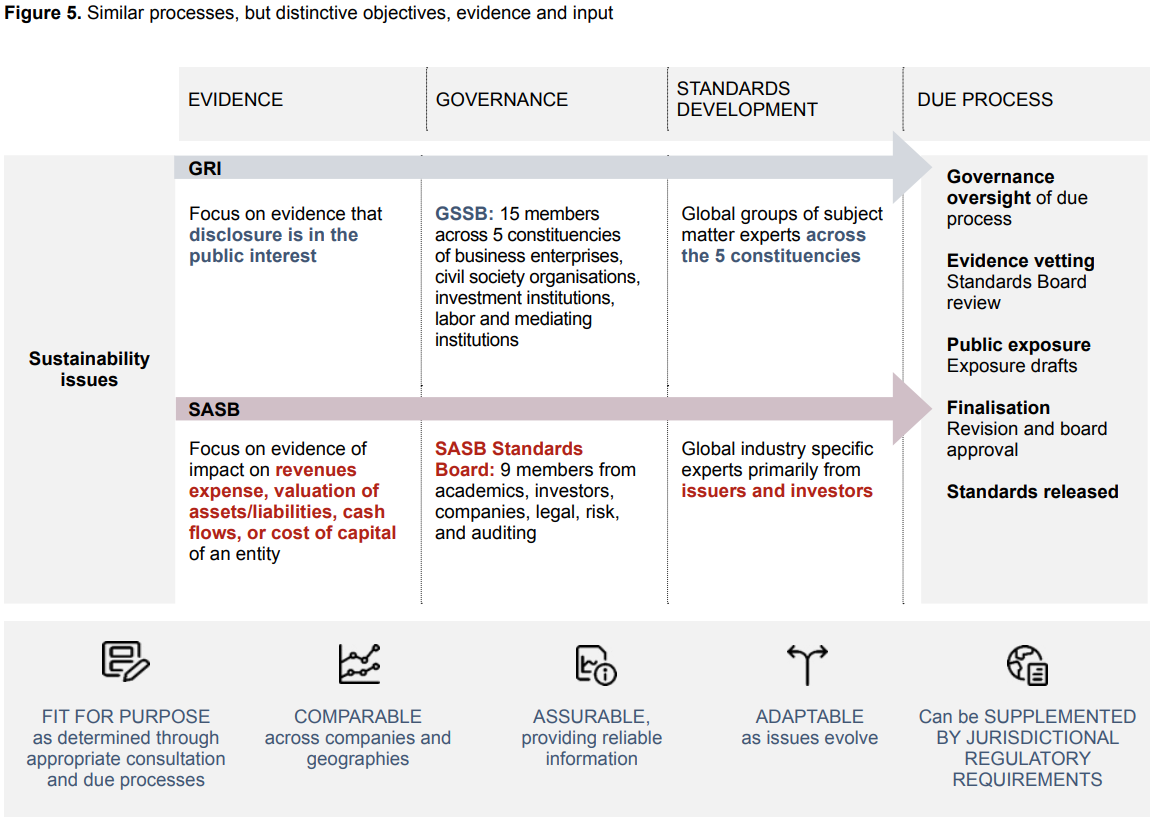

In September 2020, the five leading voluntary frameworks and standard-setters – CDP, the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) announced they would work together toward comprehensive reporting, meaning they are aligning their standards and integrating them with financial standards. This collaboration is much overdue. Over the last two decades, a number of sustainability frameworks and standard setting bodies have emerged causing companies and investors to pick and choose which framework(s) or standard(s) to align with.

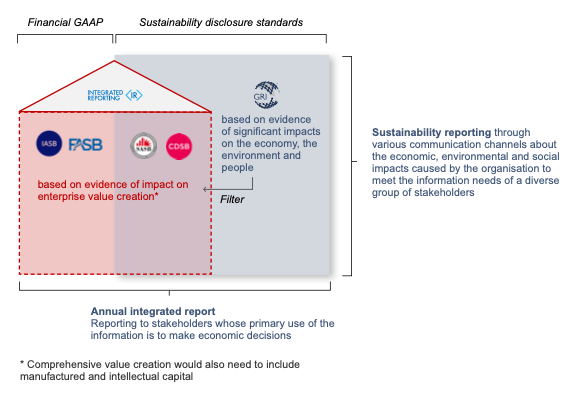

Investors might be asking your organization to align with one framework while other stakeholders want another, and you only have the resources to respond to one standard or framework. Standard setters and framework creators have realized that companies are struggling with what to disclose and to which reporting body thus taking time away from actually working toward climate solutions instead of reporting on them. Therefore, the top five came together to create a “shared vision for how existing sustainability standards and frameworks can complement generally accepted financial accounting principles (Financial GAAP) and serve as a basis for a coherent and comprehensive corporate reporting system”.

The use of wording has been very deliberate in the announcement, stating that the institutions are collaborating and focused on providing market guidance on how the frameworks and sustainability reporting standards can be applied in complementary and additive ways. Despite not being an actual convergence of the frameworks and standards into one comprehensive standard, it is progress. One of the main goals of the collaboration is integrating sustainability reporting with mainstream financial disclosures.

Companies that want to accomplish their sustainability goals and inform stakeholders of their progress must prioritize sustainability reporting. It can be difficult to navigate the various reporting systems and requirements, though. This is where an expert in sustainability reporting can be useful. A sustainability reporting consultant can assist business units in implementing thorough corporate sustainability reporting framework and achieving sustainability goals with their experience and knowledge. They can provide expert guidance on available corporate sustainability framework for consulting. By using consulting frameworks, companies can evaluate the different sustainability reporting frameworks available and choose the one that best meets their requirements.

The figure below from the Statement of Intent to Work Together Towards Comprehensive Corporate Reporting, shows what an integrated report would look like with the term integrated meaning integrated with financial disclosure.

The World Economic Forum in collaboration with Deloitte, EY, KPMG, and PwC released a white paper, Measuring Stakeholder Capitalism Towards Common Metrics and Consistent Reporting of Sustainable Value Creation. Through working groups, experts in the field, and company feedback, the report created 21 core metrics which “are primarily quantitative metrics for which information is already being reported by many firms (albeit often in different formats) or can be obtained with reasonable effort.” They also include a set of 34 expanded metrics and disclosures “that tend to be less well-established in existing practice and standards and have a wider value chain scope or convey impact in a more sophisticated or tangible way, such as in monetary terms.”

These sets of metrics are grouped in alignment with the UN Sustainable Development Goals (SDGs) and include four pillars - Principles of Governance, Planet, People and Prosperity. Rather than reinvent the wheel, these standards and disclosures are drawn from existing ones wherever possible and they’ve been carefully selected for their “universality across industries and business models”. However, Richard Howitt from Triple Pundit points out that “many touchstone issues are included in the ‘extended’ metrics which means they may easily be excluded from comparable and consistent reporting. These include political lobbying, science-based targets, resource circularity, freedom of association, the living wage, social value and business and human rights issues.” Despite the shortcomings, there are benefits to this collaboration.

What benefits can we expect from this announcement?

In the Measuring Stakeholder Capitalism Towards Common Metrics and Consistent Reporting of Sustainable Value Creation White Paper, the four pillars are subdivided into themes, metrics and disclosures and sources. For example, under the people pillar is the theme of dignity and equality. Four metrics and disclosures are listed with corresponding sources, so you know which GRI standard, CDP response, SEC regulation, SASB report and others it maps to. By creating that document, it should make disclosure easier for reporters since the information is in one central location, however reporters will still need to fill out the CDP questionnaire(s) separately. Reporters will likely be more efficient with reporting since they won't have to flip back and forth between all the different standards, so they’ll have more time for driving impact.

Investors can more accurately compare and evaluate their investments’ ESG information rather than relying on the black box of ESG raters and rankers. Investors will see ESG information alongside financial information which means less documents to review. Including ESG with financial information allows investors to critically compare and review the business holistically instead of seeing ESG as an additional consideration.

Producing an integrated report demonstrates to stakeholders that the company weighs ESG information equally to financial information. If all organizations start moving toward integrated reporting using the same metrics, ESG reporting will become like financial reporting - standardized and eventually, hopefully mandatory.

Written by Josh Prigge and Dana Wilke